Understanding Insurance for Landlords

Landlord Insurance

Introduction to Landlord Insurance: An Essential Investment

The journey to becoming a landlord in the ever-evolving realm of real estate can be a thrilling rollercoaster of rewards and challenges. As an experienced real estate investor, I can attest to the importance of intelligent safeguards. Your property and financial health are at stake, and unexpected events can be just around the corner.

Landlord Insurance: Your Lifeline in the Unpredictable Rental Landscape

Here’s where landlord insurance shines as your protective shield, a crucial investment that promises comprehensive coverage and that much-needed peace of mind. Let’s demystify this game-changer for landlords.

Landlord Insurance vs Homeowner’s Insurance: Know the Difference

Landlord insurance is a tailored product designed for property owners leasing or renting their properties. It’s different from your regular homeowner’s insurance, which focuses on protecting your primary residence. In contrast, landlord insurance zeroes in on the unique risks that come with tenant occupancy.

👉Pro-Tip: Understanding the fine print of your insurance policy is vital. Don’t hesitate to consult with an insurance professional to clarify any doubts. Work with someone specializing in landlord insurance, as it’s a very different product.

Navigating the Risky Terrain of Property Rental

In the world of property rental, accidents, and unforeseen incidents are part of the journey. From a burst pipe flooding your property to a fire resulting from a faulty wire – these incidents could put a dent in your property and your wallet without adequate protection. Not to mention having a tenant or guest severely injure themselves at the property.

Breaking Down Your Coverage: The Anatomy of a Landlord Insurance Policy

To decode the mystery of landlord insurance policies, let’s take a closer look at what coverage they usually offer:

Coverage Area | What it Means for You |

|---|---|

Physical Structure | Repairs or replacements are covered for damages due to incidents like fire, storms, vandalism, or theft. |

Landlord’s Personal Property | Protection for any personal property left on the rental premises for use by tenants. |

Loss of Rental Income | You can recoup lost income during periods when the property is uninhabitable due to unexpected events or tenant default. |

Estimating the Cost of Peace of Mind: Landlord Insurance Pricing

The cost of landlord insurance can vary based on factors like property location, type, condition, and even your claims history. It’s advisable to gather quotes from multiple reputable insurers to get a realistic estimate. There are companies like Steadily (read our review) that shop these rates for you and take a lot of the legwork out of it.

👉Pro-Tip: Insurance providers often offer discounts for landlords with multiple properties. Be sure to ask about these when seeking quotes.

Investing in Your Safety Net: The Final Verdict

As a landlord, safeguarding your assets should be a top priority. Landlord insurance offers comprehensive coverage to shield you from potential financial risks. You’ve invested in your rental property’s long-term profitability by fully understanding your coverage and obtaining appropriate quotes. Stay tuned as we delve deeper into landlord insurance in the following sections.

Exploring the Comprehensive Coverage of Landlord Insurance

As a seasoned landlord, I can’t emphasize enough the significance of landlord insurance in fortifying your property investment. It’s more than a safety net—it’s an essential shield offering comprehensive coverage beyond the reach of a traditional homeowner’s policy. Delving into the depths of landlord insurance coverage will equip you to make savvy decisions, ensuring the safety and profitability of your rental properties.

Landlord Insurance: The Two Pillars of Protection

Landlord insurance is a protective barrier for your rental properties, primarily structured around two core coverage areas: property and liability protection.

- Property Protection: This shields against perils like fire, vandalism, theft, or natural disasters. Property protection has your back if disaster strikes, causing damage or destruction to your rental property, financially safeguarding you against significant losses. Your coverage isn’t limited to the primary rental property—it often extends to other structures, such as garages or sheds.

- Liability Protection: This protects you against legal and financial liabilities from accidents or injuries on your rental property. Take, for instance, a tenant slipping on an icy patch outside one of your properties, resulting in medical expenses, or even a lawsuit—liability coverage is your knight in shining armor.

👉Pro-Tip: Regularly assess and update your insurance coverage to align with your evolving needs as a landlord. If your property value goes up, your insurance should too.

Bonus Coverage: The Unsung Hero of Landlord Insurance

Some landlord insurance policies offer additional coverage options—these could be the saving grace when your property becomes uninhabitable due to events like fire or water damage. This loss-of-rent coverage ensures you don’t lose out on rental income during repair periods. Here are some of the extra coverage points to look for

1. Loss of Rent Coverage: Also known as fair rental income protection, this coverage helps replace lost rental income if a property becomes uninhabitable due to a covered peril such as a fire or severe storm.

2. Legal Expense Coverage: In the unfortunate event of a legal dispute with a tenant, this coverage can help offset the costs of legal fees and court costs.

3. Landlord Contents Coverage: This protects items owned by the landlord that remain on the property for use by the tenant, such as appliances, furniture, or tools.

4. Natural Disaster Coverage: While some natural disasters may be covered under standard policies, certain events, such as floods and earthquakes, often require separate coverage.

5. Vandalism and Malicious Damage Coverage: This coverage can protect you from damage to your property caused intentionally by tenants or other individuals.

6. Emergency Coverage: This covers the cost of emergency repairs that need to be performed on your rental property, such as fixing a broken lock or window to secure the property.

7. Building Code Upgrade Coverage: Ordinance or Law coverage can help pay for required upgrades to your rental property to meet current building codes during a covered repair or rebuild.

8. Accidental Damage Coverage: This type of coverage can protect landlords from accidental damage to the property caused by tenants, like a broken window or damaged door.

Why Renters Insurance should Still Be required from the Tenant

While landlord insurance is essential for property owners, it’s equally important to encourage or require tenants to obtain renter’s insurance for their personal belongings. This dual coverage ensures all parties are adequately protected, minimizing potential disputes and financial risks.

Tenant insurance can also help ensure that damage they cause to your property will be covered in certain situations. It’s a good idea to set required limits on your tenants and keep a copy of their renter’s insurance on file so you have the information if needed. A good property management company should be doing this for you.

Securing the Future: Landlord Insurance for Long-Term Profitability

Landlord insurance is more than a safety measure—it invests in your rental properties’ long-term profitability and safety. From property protection to liability coverage, understanding the intricate components of a landlord insurance policy is paramount. By comparing quotes, you can secure optimal coverage tailored to your unique needs, ensuring peace of mind and protecting your investment.

🕵️♀️Stay Tuned: In the following sections, we’ll further dissect landlord insurance policies and delve into how to obtain the best rates on the market.

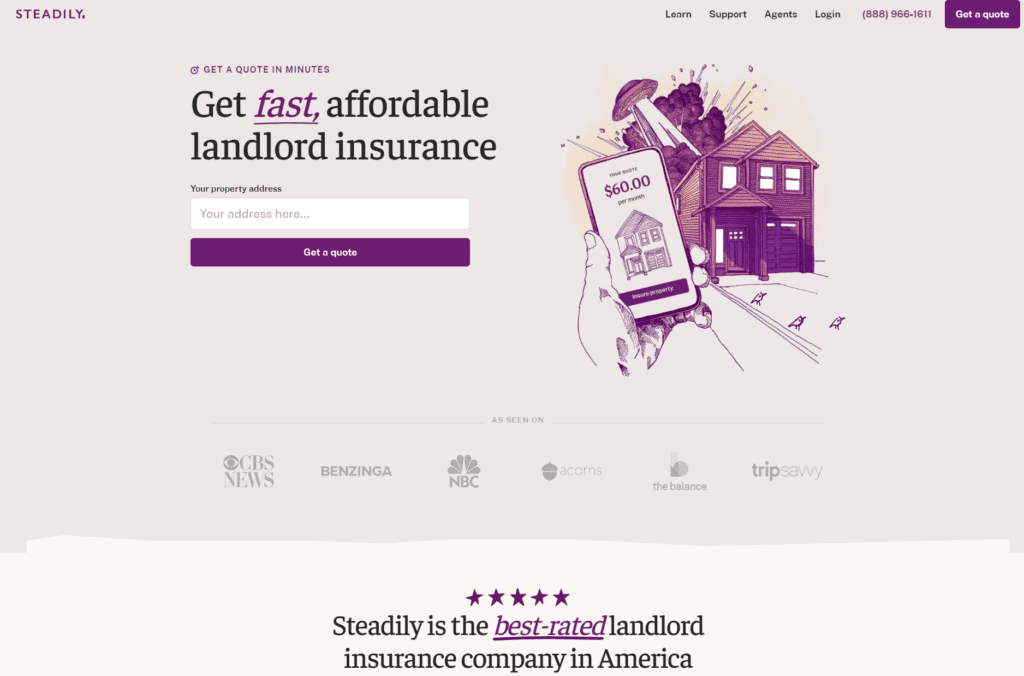

How to Obtain a Competitive Landlord Insurance Quote

Steadily Landlord Insurance is a service provider that specializes in covering rental properties from a variety of threats, such as fire, theft, and vandalism, among others. It also includes liability coverage should a tenant suffer an injury within your property. Regardless of the scale of your real estate investments, Steadily offers affordable and straightforward policies, ensuring you understand exactly what you're purchasing.

Ready to dive into the world of landlord insurance quotes? Strap in, because we’re about to embark on a thrilling journey, and by the end of it, you’ll be an expert on obtaining a competitive quote that suits your needs to a T.

Step 1: Research—Don’t Just Google, Deep Dive

Start your adventure by investigating potential insurance providers. Look beyond the glossy ads to find companies with a solid reputation, financial stability, and rave reviews. Keep your eyes peeled for those with experience in landlord coverage—they will likely have the tailored options you need.

👉Pro Tip: Comprehensive coverage is the name of the game. Ensure your insurer knows their way around the block (literally!). They need to understand your property’s specific needs and risks.

Step 2: Gather Your Facts—Every Detail Counts

It’s time to play detective with your property. Pull together the vital stats—location, age, construction type, tenant count, security features, and claim history. Be honest and thorough; these details help insurers understand the risk and craft a fitting policy.

Bonus Point: Don’t forget about natural disasters or damage from tenants. The devil is in the details, and these might be essential factors in your coverage.

Step 3: Consistency is Key—Cross Your Ts and Dot Your Is

When collecting quotes, ensure the details you provide are accurate and consistent across all applications. Discrepancies might lead to quote variations or rejection, and we don’t want that, do we?

Step 4: Bring in the Pros—Consider an Insurance Broker

Navigating the landlord insurance landscape can be daunting. Why not enlist a savvy independent insurance broker? They can leverage their insider knowledge and network to negotiate competitive rates, ensuring you’re adequately covered.

Step 5: Look Beyond the Price Tag—Coverage Matters

Remember, the cheapest option isn’t always the best. Evaluate deductibles, payout limits, liability coverage, and additional endorsements. The right policy offers more than just a safety net—it offers peace of mind. When I was first starting out, I can’t tell you how many nights I laid in bed worrying about a property I owned that I knew had a bad roof and a very high deductible insurance. Anytime there was a storm, I couldn’t sleep a wink.

And there you have it. With these steps in your toolkit, you’re well on your way to securing a competitive landlord insurance quote.

Cost Analysis: What Determines the Cost of landlord insurance

So, you’re curious about the price tag attached to peace of mind in the world of rentals, aka landlord insurance. Strap in as we peel back the layers of this financial onion and delve into what influences the average cost of landlord insurance.

1. Location, Location, Location!

Here’s the thing – not all neighborhoods are created equal. Your rental property’s location significantly affects your landlord insurance cost. Properties in high-crime areas or regions prone to natural disasters carry a higher risk, and this is reflected in the insurance premiums. On the flip side, properties in safer, low-risk zones can enjoy more economical rates.

👉Pro Tip: Research your property’s neighborhood risk profile thoroughly before you purchase—it will be a vital factor when requesting quotes. If you buy a property all-cash in a flood zone, you may be surprised at how high the insurance is or that it isn’t available at all!

2. The Nitty-Gritty of Your Rental Property

Next up on the cost influencers’ list is your rental property’s specifics. Insurers will evaluate factors such as the size, building materials, and extra features (think swimming pools or detached garages). These influence the property’s replacement value and the potential risks involved and are probably apparent to most investors.

Property Factor | Potential Impact |

|---|---|

Size of Property | Larger properties typically cost more to insure due to higher potential replacement costs. |

Building Materials Used | More durable materials may result in lower insurance premiums. |

Extra Features | Features like pools can increase insurance costs due to the higher risk of liability claims. |

3. Coverage Choices—It’s More Than Basic

The type and extent of coverage you opt for will play a part in your premium. A basic policy typically covers property damage from incidents like fire or vandalism. More comprehensive policies that offer liability coverage or loss-of-rent coverage will cost more.

4. Personal Claims History—Your Track Record Counts

Your previous claims history can impact your premium costs. Landlords with frequent claims or previous lawsuits may face higher premiums as they’re considered high-risk. After having a roof paid for by insurance, my premiums went up quite a bit the next year. However, it was far less than the cost of the roof.

5. Your Deductible: High or Low?

Just like other types of insurance, your deductible — the amount you’ll pay out-of-pocket before insurance coverage kicks in — can influence your landlord insurance cost. Higher deductibles typically result in lower premiums and vice versa.

👉Pro Tip: Remember, you’re not just buying a policy—you’re also buying peace of mind. Make sure to balance cost with adequate coverage. Too high of a deductible can cause extreme hardship to a novice investor, don’t gamble.

6. Rental Property Age and Condition

Older properties or those in poor condition may require higher premiums because they’re typically more prone to damage and costly repairs. Conversely, newer, well-maintained properties may qualify for lower rates.

Property Condition | Potential Impact |

|---|---|

Age of Property | Older properties often have higher premiums due to potential maintenance issues. |

Property’s Current State | Poorly maintained properties might be seen as high risk and have increased premiums. |

7. Tenant Type: Who’s Living in Your Rental Property?

The type of tenant you have can also impact your premium. For example, if you rent to students or short-term vacationers, you may face higher premiums due to the increased risk of damage or liability claims. Many owners I know don’t realize that their Air BnB will come with increased insurance rates and are surprised to find out how much more it can cost.

8. Additional Coverage: Special Endorsements & Riders

Adding optional coverage for scenarios not included in standard policies can also increase the cost. For example, you may choose to add coverage for sewer backup, flood, or rent guarantee insurance as covered earlier in the article. Many of these are low cost, low frequency claims, but can come in handy when they are needed. Again, these are often just for peace of mind.

Understanding the Benefits of Landlord Liability Insurance

As a savvy real estate investor, you know the importance of covering all bases. Landlord liability insurance is one essential tool in your defensive lineup. It shields you from the potential curveballs that life (or rather, tenants) can throw your way.

Shielding Your Pocket from Bodily Injury Claims

Life happens, right? Sometimes, accidents occur on your property, and if a tenant or visitor gets hurt, you could be staring down the barrel of a liability lawsuit. That’s where landlord liability insurance steps up to the plate.

Pro Tip: Landlord liability insurance covers medical expenses, legal fees, and any settlements arising from injuries on your property. So, you can breathe easy knowing you’re financially safeguarded against such events.

Protection Against Property Damage Claims

Sometimes tenants get a little too “creative” with your property. Whether it’s accidental damage or intentional, it can lead to hefty repair costs. Good news! Your landlord liability insurance has got you covered.

Legal Defense Against Wrongful Eviction and Privacy Invasion Claims

Evictions can be tricky, even if you’ve followed all legal procedures to a T. Disputes can still arise, and accusations of privacy invasion can pop up unexpectedly. Enter landlord liability insurance to save the day with coverage for legal fees and potential damages awarded to the tenant.

Guard Against Libel and Slander Claims

In today’s digital era, words fly faster than ever. That includes potentially defamatory statements about you connected to your rental property. With landlord liability insurance, you’re protected against libel and slander claims.

👉 Pro Tip: Remember, your landlord liability insurance does not cover everything. Always take the time to comb through your policy to understand the specifics of what is covered and what limitations or exclusions may apply. Consider umbrella coverage as well, which can be very cheap.

Landlord liability insurance is not just a safety net; it’s your peace of mind. By safeguarding you from potential legal and financial repercussions, you can focus on expanding your property empire without fear of the unknown.

Who Pays for Landlord Liability Insurance

Some prospective owners may not like this answer, but it’s rather simple: you, the landlord pays for this type of insurance. Its becoming more and more popular to shift costs onto tenants, but at this point is common practice for the owner to pay this insurance for several reasons.

- It’s too important to trust the tenant to pay for this cost directly. If they forget or stop payment, you would be putting your entire investment at risk, plus the liability that comes with injury or other problems with the property.

- The cost is in place of homeowners insurance, which is the responsibility of anyone who owns a home, so it makes sense that the owner would also pay for this type of inurance.

Case Study of a former client: Real-Life Applications of Landlord Insurance

One prime example that highlights the real-life applications of landlord insurance can be found in the case of one of our clients, lets call him, Mr. Johnson. He was a newerd property investor with a very small rental portfolio. Mr. Johnson had been diligently maintaining his properties and had always considered himself well-protected by his landlord insurance policy.

However, he encountered an unforeseen incident when a fire broke out in one of his rental units due to faulty wiring. In this unfortunate event, the fire caused significant damage to the property’s structure and contents. In filing the claim, he found at that insurance would not cover any of the internal damage to things like appliances or carpeting, and that he also had a $15,000 deductible. Fortunately, he had the cash reserves to remedy the situation, but this set back his investment goals by almost 7 years with the property.

Adequate coverage protects your investment and safeguards the financial well-being of both you and your tenants in unforeseen circumstances. To ensure you secure the best possible coverage, obtaining multiple landlord insurance quotes from reputable providers and carefully comparing their terms, coverages, and costs before making an informed decision is essential.

FAQs and Misconceptions

As with any insurance product, landlord insurance often has its fair share of frequently asked questions and common misconceptions. This section aims to address some of these queries and clarify the matter.

1. What insurance do I need as a landlord?

One common question many landlords have is what type of insurance they need.

Landlord insurance typically consists of two main components: property and liability insurance. Property insurance covers the physical structure of your rental property in case of damage from fire, storms, vandalism, or other covered perils.

Liability insurance protects you against legal claims made by tenants or third parties for injuries or damages on your property.

2. Who pays for landlord liability insurance?

Another commonly misunderstood aspect is who bears the financial responsibility for landlord liability insurance. While it is ultimately up to each landlord to decide whether to include liability coverage in their policy, it is highly recommended.

The landlord themselves typically bears the cost of landlord liability insurance; however, landlords often incorporate this cost into their overall rental pricing strategy.

3. How much is landlord insurance?

The cost of landlord insurance can vary depending on many factors, such as location, size and condition of the property, coverage limits, deductibles, and more. On average, landlords can expect to pay between 15-30% higher premiums than regular homeowners’ policies due to the increased risks of renting out a property.

Obtaining multiple quotes from different insurers is essential to ensure you get the best coverage at a competitive price.

4. What does landlord insurance cover?

Landlord’s policies typically cover the dwelling (the physical structure) and any personal property you own but keep at the rental property (such as appliances or furniture). These policies often include coverage for loss-of-rent if your tenant cannot occupy the property due to a covered claim and liability coverage.

It’s essential to carefully review the terms and conditions of your specific policy to understand the extent of coverage in detail.

5. What other misconceptions should I be aware of?

One common misconception is that landlord insurance covers a tenant’s personal belongings. This is incorrect; tenants are responsible for their own belongings and should obtain renters insurance for this purpose.

Another misconception is that landlord insurance is unnecessary if you have homeowners’ insurance on your rental property. In reality, homeowners’ policies typically exclude coverage when you rent out your property, making landlord insurance essential for proper protection.ty.

Conclusion: The Long-Term Value of Comprehensive Landlord Insurance

It is abundantly clear that investing in comprehensive landlord insurance is an essential step for any property owner or investor. One can safeguard their investment and financial well-being by recognizing the potential risks and liabilities of being a landlord.

Understanding the intricacies of a landlord insurance policy and obtaining competitive quotes allows landlords to make informed decisions regarding coverage options. While the cost of landlord insurance may vary depending on factors such as property type, location, and coverage limits, it is a worthy expenditure when weighed against the potential financial repercussions of unforeseen events.