The Pros and Cons of Real Estate Investing: The Definitive Guide

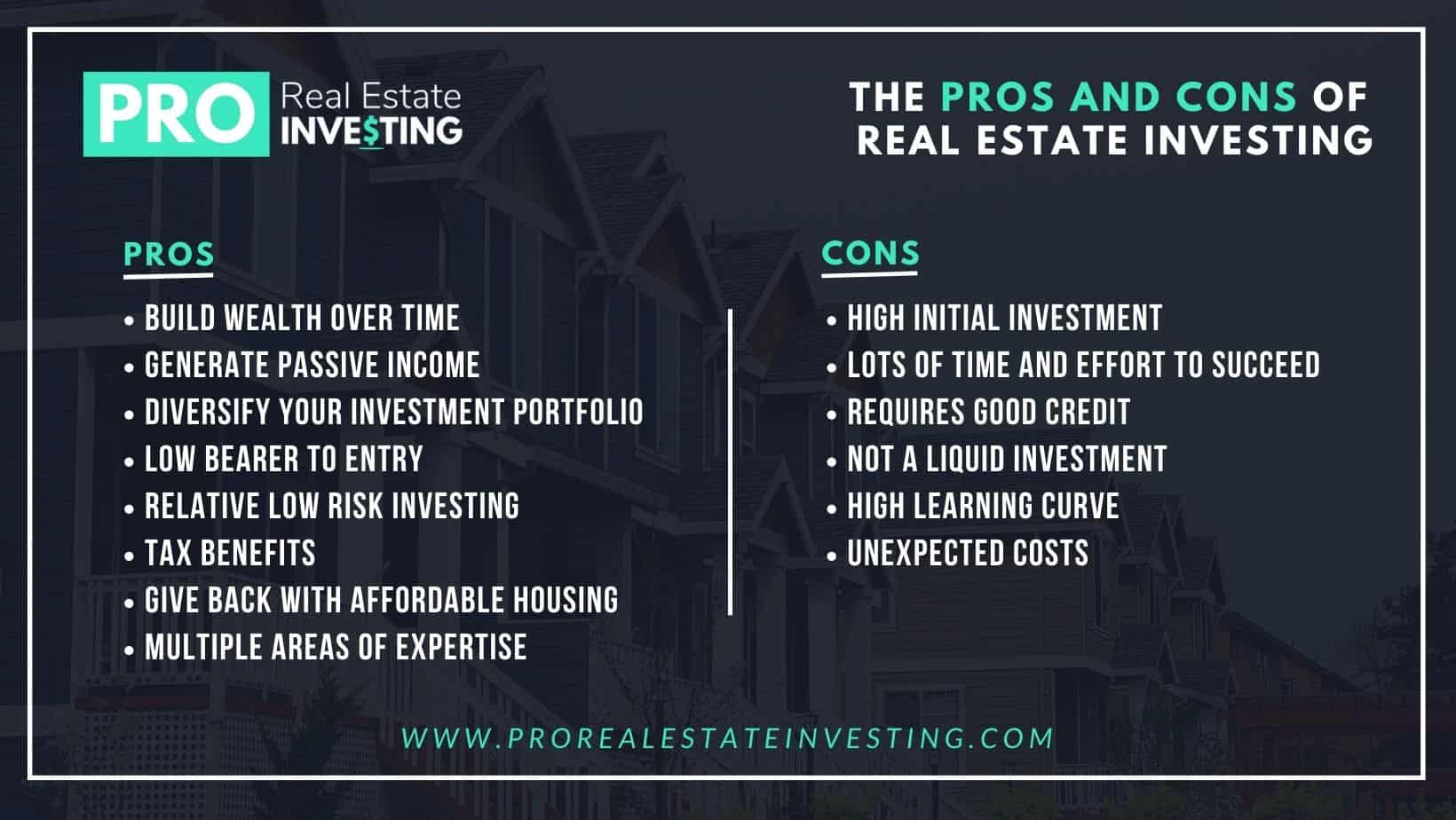

- Pros of Real Estate Investing

- The Cons of Real Estate Investing

- Common Questions About Real Estate Investing

- What is real estate investing?

- Why should I invest in real estate?

- What are some ways to invest in real estate?

- How much money do I need to get started?

- What are some risks associated with real estate investing?

- How do I find suitable real estate investments?

- What are some tips for success in real estate investing?

- In Summary

Making money through real estate investing is a dream for many people. However, it’s essential to understand this type of investment’s pros and cons before you start. This definitive guide will explain everything you need to know about real estate investing. We’ll discuss the benefits, as well as the risks involved in this type of investment. By the end of this article, you’ll be able to make an informed decision about whether or not real estate investing is right for you!

Pros of Real Estate Investing

Build Wealth Over Time

Real estate investing is a great way to make money and build wealth over time. This is because, as a property owner, you can earn rental income, appreciation, and tax breaks. These benefits can help you build wealth over the long term.

Generate Passive Income

Passive income has been a buzzphrase for the past ten years, but few investments are as passive as real estate. This means you can make money without actively working for it as much as you would for a full-time job, and the ability to earn is nearly limitless compared to trading your time for money. Real estate investing can be a great way to generate extra income, specifically if you aim to accumulate wealth over time to become more financially independent.

Diversify Your Investment Portfolio

Real estate investing is a great way to diversify your investment portfolio. Adding real estate to your broad portfolio can spread out your risk. Investing in stocks, bonds, and mutual funds is a great investment strategy; however, owning physical real estate offers investment growth and tax benefits that few other investments can compete with.

Low Bearer to Entry

You can become a real estate investor with as little as $500. You can also use leverage to finance your investment, which means you can control property worth much more than your invested money. This low barrier to entry makes real estate investing one of the most accessible investments for people with limited capital.

Relative Low Risk

Real estate investments are relatively low risk, especially when compared to the large fluctuations of the stock market and other riskier investments. Real estate prices tend to be fairly stable over time, with gradual appreciation in value.

Plenty of Options to Fit Your Investing Style

There are many different ways to invest in real estate, so you can find one that fits your needs and interests. For example, you can spend time fixing and flipping homes if you are handy. Or, if you are a strong salesperson, you may be good at wholesaling. Real estate provides options for many different skill sets.

Tax Benefits

Real estate investors often enjoy tax benefits that other investors don’t receive. For example, you can deduct the cost of your mortgage interest, property taxes, and repair costs from your generated income. Depreciation is also incredibly powerful, as you can treat your real estate as a depreciating asset on your taxes when, in reality, real estate typically appreciates over time. These deductions can save you a lot of money come tax time! There are also tools like 1031 exchanges that can defer your tax hit on a sale.

Give Back With Affordable Housing

Investing in real estate can allow you to help others by providing them with affordable housing. By being a landlord, you can work with local government entities to develop affordable housing in key areas of your city. Many developers focus on this type of real estate and do quite well. This is a great way to give back, especially if you are passionate about helping those in need.

The Cons of Real Estate Investing

When examining the riches many real estate investors have made, it is easy to assume that the path to real estate wealth is an easy trek. However, this couldn’t be further from the truth, and real estate investing is not for everyone. Real estate investing also has some downsides that you should be aware of before you start; here are just a few:

High Initial Investment

You may be thinking that one of the pros listed above mentioned that there was a “Low Bearer to Entry” did the person writing this article even pay attention? Yes, we did! If you want to buy physical real estate, it will require a high initial investment or a hard money lender. This can make it difficult for some investors to get started. There are ways to obtain financing with little money down, but that isn’t always easy.

It takes Time and Effort to Be Successful

Investing in real estate takes time and effort to be successful. You must research the market, find good properties, and manage your tenants. While this is possible as a side hustle, it will likely take up most of your free time if you want to succeed.

Requires Good Credit

You will likely need good credit to finance your real estate investments. This can be difficult for some people to obtain if they haven’t paid attention to their credit or are too young to develop it.

It May Be Difficult to Sell Your Property

Real estate is usually not a liquid investment unless you are focused solely on something like a REIT. It may be difficult to sell your property if you need to liquidate your assets quickly. This is because real estate can take longer to sell than other investments, such as stocks or bonds.

High Learning Curve

While not every aspect of real estate investing has a high learning curve, such as investing in REITs or Crowdfunding, the other types of real estate ownership require a lot of knowledge. While you can get lucky and buy a great property at a great price, the odds of this happening are very low if you don’t know what you are doing.

Unexpected Costs

For any period, anyone involved in real estate ownership will have stories of flooding basements, roofs leaking, ACs breaking, or examples of other unexpected catastrophes. These events can always be budgeted for, but to the initiated or someone just getting started, they can create huge setbacks and perhaps turn them off from real estate investing forever.

Common Questions About Real Estate Investing

Real estate investing can be an exciting and rewarding way to build wealth over time. If you’re considering getting started, here are some common questions and answers to help you on your journey:

What is real estate investing?

Real estate investing is the act of purchasing property to make a profit through appreciation, rental income, or both.

Why should I invest in real estate?

Real estate has the potential to generate long-term wealth through passive income and appreciation. It’s also a tangible asset that you can see and touch, unlike stocks or bonds.

What are some ways to invest in real estate?

There are many ways to invest in real estate, including buying rental properties, flipping houses, investing in REITs (real estate investment trusts), or participating in real estate crowdfunding.

How much money do I need to get started?

The amount of money you need to get started depends on the type of real estate investment you choose. For example, buying a rental property typically requires a down payment of at least 20% of the purchase price, while investing in a REIT may require a minimum investment of a few thousand dollars.

What are some risks associated with real estate investing?

Real estate investing comes with its own set of risks, such as vacancy rates, maintenance costs, and fluctuations in the housing market. However, these risks can be mitigated by conducting thorough research, working with experienced professionals, and diversifying your portfolio.

How do I find suitable real estate investments?

To find good real estate investments, it’s important to research the local housing market, work with experienced real estate professionals, and stay up to date on current trends and regulations. Networking with other investors can also provide valuable insights and opportunities.

What are some tips for success in real estate investing?

Some tips for success in real estate investing include conducting thorough due diligence, being patient and disciplined, and building a team of trusted professionals. It’s also important to have a long-term perspective and a clear investment strategy.

In Summary

As you can see, there are both pros and cons to investing in real estate. You should consider these before deciding whether real estate investing suits you. However, if done correctly, real estate investing can be a great way to build wealth and achieve financial freedom.