Get Started Investing in Real Estate: 10 Steps to Success

Are you ready to get started in real estate investing? If so, you’re making an intelligent decision! Real estate is one of the best ways to create wealth and build long-term financial security. However, getting started can be tricky. There are many things to consider before you begin investing. This blog post will outline ten steps to help you get started on the road to success!

1. Understand Your Limitations

The first step to getting started in real estate investing is to understand your limitations. You need to know how much money you have available to invest and your risk tolerance. This will help you determine what real estate investments are suitable for you.

Real estate investing can be lucrative, but there are several common limitations beginning real estate investors may face. Here are some examples:

Limited Funds: Real estate investment often requires significant capital upfront, and many beginning investors may not have the funds to invest in a property outright. This can limit their options to finding investment partners, taking on debt, or starting with smaller properties.

Limited Knowledge: Many beginning investors may lack experience or knowledge in real estate investing. This can make it difficult for them to identify opportunities, negotiate deals, and make informed investment decisions.

Limited Access: Access to good deals and properties is often challenging for beginning investors. This is because experienced investors typically have established relationships with real estate agents, brokers, and other investors, which gives them first access to the best deals.

Limited Time: Real estate investing can be time-consuming, requiring significant effort and commitment to find and manage properties. Beginning investors with limited time due to other obligations, such as a full-time job, may struggle to dedicate the necessary time to make informed investment decisions.

Regulatory Limitations: Local and federal regulations can also limit the opportunities available to beginning investors. This includes zoning regulations, building codes, and other legal requirements that must be met when investing in real estate.

To overcome these limitations, beginning real estate investors can seek out education, network with experienced investors, and start small with manageable investments while keeping in mind the risks involved in any investment decision.

2. Do Your Research

Before you make any decisions, it’s essential to do your research. There are many real estate investments, and you need to choose the one that best suits your needs. It would be best to familiarize yourself with the local real estate market. Start to ask people you trust and research real estate professionals who can help you in your journey, which we will learn more about in just a second. Here are some great ways to begin researching as you get started investing in real estate.

Analyze Market Trends: Research the real estate market where you plan to invest. Look at historical sales data, price trends, and vacancy rates to determine the potential for growth in the area.

Evaluate the Neighborhood: Research the neighborhood where the property is located. Look at factors such as crime rates, schools, local amenities, and transportation access to determine the potential for demand in the area.

Assess the Property: Before investing in a property, conduct a thorough inspection to assess its condition and identify any repairs or upgrades that may be necessary. This will help you determine the costs associated with the property and whether the potential return on investment justifies the purchase.

Estimate Rental Income: If you plan to rent the property, research the local rental market to estimate the potential rental income. Consider factors such as the location, size, and condition of the property and the local rental rates for similar properties.

Network with Professionals: Build relationships with real estate agents, property managers, and contractors who can provide you with valuable information and advice on the local real estate market. This can help you make informed investment decisions and identify potential investment opportunities.

There are many types of real estate investments, and you need to choose the one that best suits your needs.

Matt Cochrell, Author, Real Estate Broker

3. Understand Capitalization Rates or “Cap Rates.”

Understanding cap rates is an essential part of real estate investing lingo. Let’s say you’re considering purchasing a rental property for $500,000, which generates an annual net operating income (NOI) of $50,000. To calculate the capitalization rate, you would divide the NOI by the purchase price:

$50,000 (NOI) / $500,000 (purchase price) = 0.10 or 10%

In this example, the capitalization rate is 10%. For every dollar you invest in the property, you can expect a 10% return based on the property’s current income.

Real estate investors use the capitalization rate to compare different investment opportunities and determine whether a property’s potential return is worth the investment. A higher cap rate typically means a higher possible return. Still, it’s essential to consider other factors such as location, market trends, and potential for future growth when making a real estate investment decision.

One of the most important things to understand when investing in real estate is capitalization rates, or “cap rates.” This is the approximate rate of return you can expect to earn on your real estate investment. Looking for properties with high cap rates is essential, as this will maximize your profits, but there are other things to consider that are equally important. It would be best to consider other factors, such as the property’s condition, location, and current real estate market. Many investors start with a solid cap rate and work from there.

4. Find Professional Partners

a. Real Estate Agent/Broker

Finding an experienced, licensed real estate agent or broker who understands the market and has experience with investment properties will be necessary. They will have access to the entire MLS and, more than likely, will be no investors that may be willing to sell their investment property. They should also be able to guide you to the types of neighborhoods that succeed with rental property and what areas are likely to appreciate.

b. Real Estate Attorney

Ask your agent about finding a qualified real estate attorney to help with the paperwork and investment process. Not all states require an attorney to close a transaction, but it is almost always a good idea to have one review your business structure and provide lease document guidance. Getting sued can create issues for any landlord, but being set up correctly with an attorney is an excellent shield from liability.

c. Property Manager

Most importantly, you will also need to find a suitable property manager if you are not planning to self-manage the property. A good property manager will keep your tenants happy and take care of all the day-to-day tasks associated with owning an investment property. Managing a rental property is a lot more work than some people thank, and good management is one of the biggest “make or break” aspects of investing in real estate.

d. Financial (Lender/Accountant)

Last but not least, it is essential to find a qualified accountant or financial advisor that can help you with tax implications and other financial matters related to owning an investment property. This doesn’t have to be the same person; in fact, it more than likely will not be. However, they are likely to work at the same firm or have close business ties that will be helpful to you down your investment journey. Real estate should be one part of your overall strategy for wealth building.

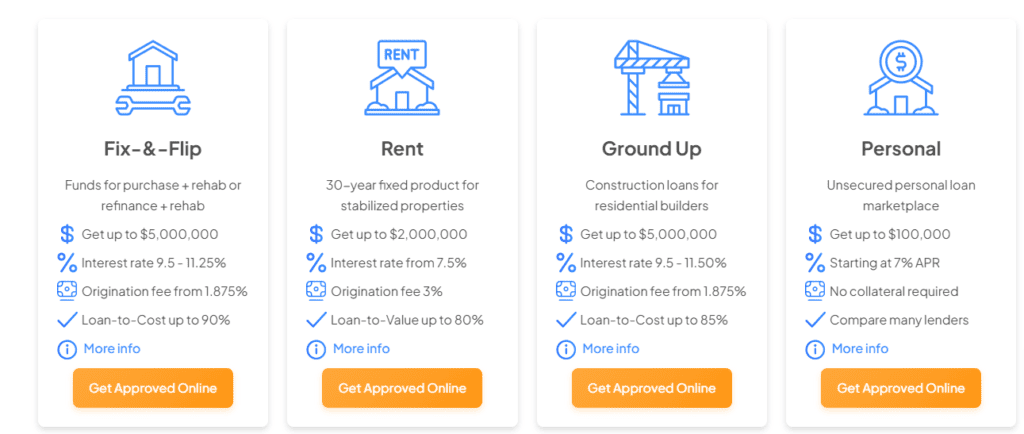

Consider a company like New Silver, which provides loans for real estate investors of all types. They work with flips, long-term holds, ground-up builds, and unsecured personal loans.

5. Take Your Time & Build Your Credit

As you can see, there are quite a few things to consider before investing in real estate. However, don’t let that discourage you! This is just the beginning, and taking your time is important. Rome wasn’t built in a day, and neither is a successful real estate portfolio. Start with baby steps if you need to, but always move forward toward your goal.

Good credit is essential for real estate investors because it can impact their ability to secure financing for investment properties. Many real estate investors rely on loans to purchase properties, and lenders often use credit scores to determine the borrower’s level of risk. A good credit score can help investors secure favorable loan terms, such as a lower interest rate, which can result in significant savings over the life of the loan.

In contrast, a poor credit score can make it challenging to secure financing or result in higher interest rates and fees, reducing the potential return on investment. Additionally, good credit can help investors establish a positive reputation in the industry and increase their chances of securing future investment opportunities. For these reasons, real estate investors should strive to maintain good credit and promptly address any issues or negative marks on their credit reports.

Consider using a service like myFiCO to track and repair your credit score.

The most important thing to remember is that you should never invest in anything you don’t understand. If something doesn’t make sense, ask questions until it does. There are no stupid questions regarding investing in real estate, only stupid mistakes. And those can be avoided by taking time, researching, and surrounding yourself with good people.

6. This Isn’t HGTV

Real estate flipping is a popular investment strategy involving buying a property, making repairs or upgrades, and selling it quickly for a profit. While many people are familiar with the concept of flipping houses through popular television shows such as HGTV’s “Fixer Upper” and “Flip or Flop,” the reality of real estate flipping is often quite different.

The timeline is one of the most significant differences between real estate flipping in real life and on HGTV. On television, flipping a house can appear to be a quick and easy process completed in just a few weeks or months. Converting a property can take much longer, sometimes up to a year or more. This is because there are often unexpected delays in the renovation process, such as permit issues, contractor delays, and unforeseen repairs, that can add time and expense to the project.

Another difference is the level of risk involved in real estate flipping. On television, flipping a house is often portrayed as a low-risk, high-reward investment opportunity. Converting a property can be a high-risk investment that requires significant capital, extensive local real estate market knowledge, and a strong understanding of construction and renovation processes.

Finally, the costs involved in real estate flipping can be much higher than what is shown on television. On HGTV, the price of renovations is often significantly lower than what would be required in real life. This is because many materials and labor costs are either not shown or are provided by the show’s sponsors. In reality, renovations can be a significant expense and quickly eat into potential profits.

In summary, while HGTV has made flipping houses seem like an easy, low-risk investment opportunity, the reality of real estate flipping is much different. It requires extensive knowledge, experience, and capital and can take much longer than what is shown on television. Investors should consider the risks and costs of real estate flipping before making an investment decision.

7. You Aren’t Donald Trump (Probably)

Your first move into real estate shouldn’t be made through the lens of any real estate mogul. Be prudent, and make sure you take the first step risk-free. This doesn’t mean that you should invest in a property with no potential upside, but it does mean that you shouldn’t be buying something expecting to “flip” it for a quick profit. A solid first investment will help you learn the ropes and give you the confidence to move on to more complicated assets.

8. Pull the Trigger

While you shouldn’t rush your decision, be confident when you find a suitable property! If you have done your due diligence, you should feel good about making an offer and becoming a landlord. Remember that there is always risk involved in any investment, but real estate can be a great way to build long-term wealth. It is widespread to get cold feet, but don’t let that stop you from getting started.

9. Quality Tenants

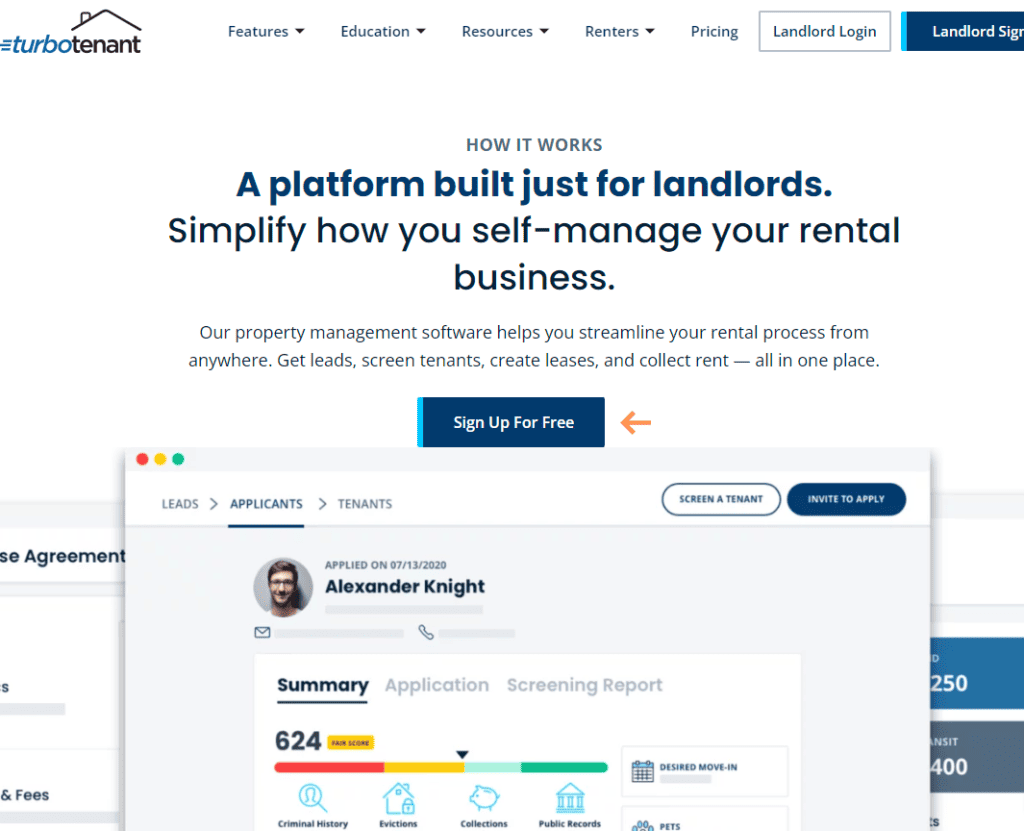

Work with your property manager or real estate agents to ensure you find quality tenants. Nothing can set back your real estate investment journey more than getting in bed with the wrong tenants. This can cause legal problems, financial headaches, and personal stress. Do your homework on any potential tenant, and don’t be afraid to ask for references or run a credit check. Any good management company should offer a comprehensive background check, credit check, criminal check, and income verification. Don’t sleep on this!

Consider using a tool like Turbotenant to help research your future tenants if you aren’t utilizing a professional property manager.

10. Budget Properly/Preventative Maintenance

As lovely as the cash flow from your investment is, don’t forget to upkeep your property. Preventative maintenance will save a ton of money in the long run. Not only will it stave off common issues that build up with dilapidated homes, but it will also keep your renters happy. Make a plan upfront with your property manager and stick to it. This will ensure that your property stays in good shape and doesn’t cost you an arm and a leg down the road.

In Summary

Investing in real estate can be a great way to build long-term wealth, but doing your homework first is essential. These ten steps should help you get started on the right foot and avoid some common mistakes new investors make. With some planning and due diligence, you can be well on your way to becoming a successful real estate investor!