Investing in Farmland REITs: A Guide for Investors

Have you sought a new way to diversify your real estate portfolio to reduce risk? While many people first consider residential or commercial real estate to invest in, Farmland offers a unique opportunity that can, understandably, seem complicated from an outsider’s perspective.

Farmland Real Estate Investment Trusts (REITs) or other new financial products that allow you to invest in Farmland may be the perfect fit for your portfolio. Farmland REITs offer investors a unique opportunity to invest in farmland, providing exposure to an asset class that has historically proven resilient, stable, and profitable.

What is a Farmland REIT?

For centuries, farmers have toiled the land, tending to crops and animals and shaping the very fabric of our society. But with the rise of modern finance, a new way of investing in this vital industry has emerged: the farmland real estate investment trust, or REIT.

At its heart, a farmland REIT is a way for investors to own a piece of the land that produces our food without all the effort. Like other real estate investment trusts, it allows individuals and institutions to pool their money and invest in a portfolio of properties managed by a professional team. But unlike most REITs, which focus on commercial or residential real estate, farmland REITs specialize in agricultural land.

Benefits of Investing in Farmland REITs

Stable Income

As mentioned, farmland REITs generate income by leasing their land to farmers. This income is typically stable and predictable, making farmland REITs an excellent option for investors seeking a steady income. The income generated by farmland REITs is typically distributed to shareholders as dividends, providing a steady income stream for investors.

Diversification and Risk Reduction

Farmland REITs provide investors with a means of diversifying their portfolios and reducing volatility. Unlike many other types of investments, farmland has been relatively resilient in times of economic downturn. This stability is primarily because farmland assets are not often subject to rapid shifts in pricing as other asset classes might be. Furthermore, these investments can also potentially provide capital appreciation over time and serve as a hedge against inflation.

Potential for Capital Appreciation

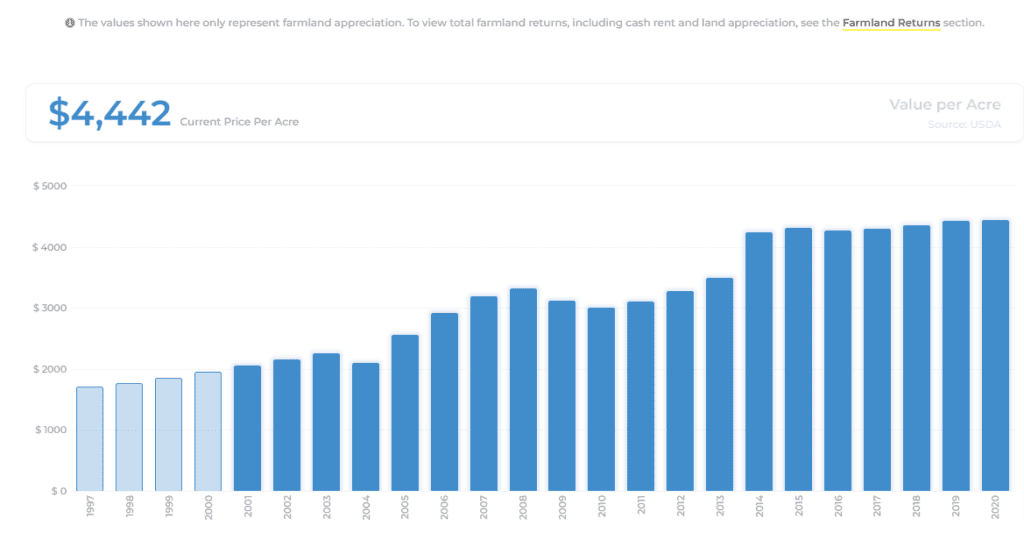

In addition to the stable income farmland REITs provide, there is potential for capital appreciation. Farmland has historically appreciated over time, which is expected to continue. As the world’s population continues to grow, the demand for food and agricultural products is expected to increase, which should drive up the value of farmland.

Socially Responsible Investment

Investing in farmland REITs can be a socially responsible investment option. Farmland REITs tend to support sustainable agriculture practices, which can help to promote environmental sustainability and support local communities. If this is important to you, it will be addressed in more detail later in the article.

Generating Income Through Dividends

Investing in Farmland REITs also allows investors to generate income through dividends. These trusts distribute income quarterly or annually, making them attractive options for those looking for steady cash flow from their investments. Additionally, it is essential to consider global food demand trends when evaluating potential dividend payments from a particular trust; if global food demand increases over time, this could lead to the increased value of farmland—and higher dividend payments for shareholders!

Farmland REIT Tax Treatment

The world of finance and the taxes that come with it is full of twists and turns that can make even the most seasoned investor’s head spin. But regarding real estate investment trusts or REITs, a few simple facts can make a big difference in how you approach these unique investment vehicles.

One of the most important things to know about REITs is that they receive special tax treatment if they follow specific guidelines regarding how much of their income they payout to investors. Rather than being subject to corporate tax, REITs can pass along their income to investors pre-tax. Once investors receive these dividends, they are taxed as ordinary income, which differs from dividends from stocks that are sometimes treated as short or long-term capital gains regardless.

But that’s not all. When investors sell their shares in a REIT, they will receive capital gains treatment, which can significantly impact their tax bill. If they hold the REIT for over a year, it will be taxed at favorable long-term capital gains rates, which can be significantly lower than ordinary income tax rates. However, if held for less than a year, it would be taxed as short-term capital gains, the same as ordinary income.

Farmland REIT Performance Metrics

Investors should consider several key performance metrics when evaluating farmland REITs. These include:

- Net asset value (NAV): This is the value of the REIT’s assets minus its liabilities, divided by the number of shares outstanding. NAV is an important metric because it gives investors a sense of the underlying value of the REIT’s assets.

- Dividend yield: The REIT’s annual dividend payment is divided by its share price. The dividend yield is significant because it gives investors a sense of the income potential of the REIT.

- Total return: This is the percentage change in the REIT’s share price plus any dividends paid over a specific period of time. The total return is crucial because it considers capital gains and dividends, giving investors a complete picture of the REIT’s performance.

These metrics are essential because they help investors evaluate the potential returns and risks associated with different farmland REITs. For example, a high dividend yield may be attractive to investors looking for income, but it could also indicate that the REIT is paying out more than it can sustainably afford to. Similarly, a low NAV may indicate that the REIT’s assets are overvalued, leading to lower returns in the long run.

Implementing these metrics is relatively straightforward. Investors can research the relevant metrics for different farmland REITs using publicly available data sources such as financial news websites or online investment platforms. Of course, performance metrics are just one piece of the puzzle regarding farmland REIT investing. It’s also essential to consider factors such as the sustainability of the REIT’s farming practices, its geographic focus, and its management team’s experience and track record.

Sustainable Farmland Investing

If climate change and sustainability are essential to you, you may be in luck! These trends have grown in recent years, and many farmland REITs have begun to prioritize environmental stewardship and sustainable farming practices in their investment portfolio. Investors can partake in these efforts and support these firms by investing in these REITs while potentially earning solid returns.

Sustainable farmland investing is about more than just doing good for the planet (although that’s a worthy goal). It’s also about hoping that sustainable farming practices have an excellent chance of leading to better financial outcomes over the long term. For example, farmers can improve soil health and fertility by using cover cropping and crop rotation techniques, leading to higher yields and more resilient crops. This is a small example from a novice, but an important one nevertheless.

Many farmland REITs have recognized this connection between sustainability and financial performance and have incorporated it into their operations. For example, some REITs prioritize working with farmers who use sustainable farming practices, such as regenerative agriculture or organic farming. Others invest in infrastructure, such as renewable energy systems or water conservation technologies, to reduce the environmental impact of farming.

Farmland REITs to Consider Investment In

AcreTrader is a platform that offers access to prime farmland investments for individuals seeking to diversify their portfolio. The company's primary offering page provides detailed information about their current offerings, allowing investors to browse and invest in various farmland opportunities.

What sets AcreTrader apart from other investment platforms is their unique approach to due diligence. Before listing a farm on their platform, AcreTrader thoroughly evaluates each property, ensuring that it meets their high standards for investment quality. Additionally, the company provides ongoing management services for their investments, making it easier for investors to track their performance and stay informed about the status of their investments.

Overall, AcreTrader's primary offering page is a great resource for investors seeking to diversify their portfolios with farmland investments. With their emphasis on due diligence and ongoing management services, the platform provides investors with the information and support they need to make informed investment decisions.